Innovation in Action: How True Sale Financing Drives Tech Startups

by Ben Jacobs

In today's ever-evolving business landscape, the Subscription Economy has redefined customer expectations, shifting the focus from ownership to access. This transformation has given rise to subscription-based businesses, collectively known as "The Subscription Economy," where companies generate revenue through recurring payments rather than traditional product sales. In this article, we will explore how B2B Buy Now, Pay Later (BNPL), BNPL in Software as a Service (SaaS), and True Sale Financing are playing pivotal roles in supporting tech startups navigating this dynamic landscape.

Understanding the Subscription Economy

Since the global financial crisis of 2008, our economic landscape has witnessed a profound shift. The era of shipping products and one-off transactions is fading, replaced by a model where companies, especially in the tech sector, depend on subscription revenue as their primary income source. This subscription-based model has become synonymous with convenience, allowing consumers to access a wide array of services, content, and products with ease. Subscribers enjoy the benefits of timely content updates, streaming services, and cost savings through installment payments.

This shift towards subscription-based business models is not limited to consumer-facing companies. It has prompted traditional technology vendors to rethink their strategies. Those unable to offer flexible usage models may face fierce competition from companies providing similar products at lower costs. This transformation puts pressure on all industries to adapt or risk obsolescence.

Working Capital Challenges for Startups

Startups, in particular, face the challenge of managing their working capital effectively. Working capital represents the cash available to cover immediate expenses such as payroll and vendor payments. With a healthy working capital, businesses have the flexibility to invest in short-term growth opportunities and meet long-term debt obligations promptly.

However, the working capital needs of startups often fluctuate throughout the year due to seasonal spending patterns and collection cycles that impact cash flow. In such situations, businesses may need to raise additional funding from investors or lenders, typically in the form of debt financing. This route, while essential for survival, often comes with its own set of challenges, including restrictive reporting requirements, equity dilution, and origination fees.

B2B BNPL and BNPL SaaS: Revolutionizing Financing

B2B Buy Now, Pay Later (BNPL) and BNPL in Software as a Service (SaaS) have emerged as innovative financing solutions tailored to the needs of tech startups. These solutions provide startups with the flexibility to manage their cash flow efficiently, particularly during periods of fluctuating working capital requirements.

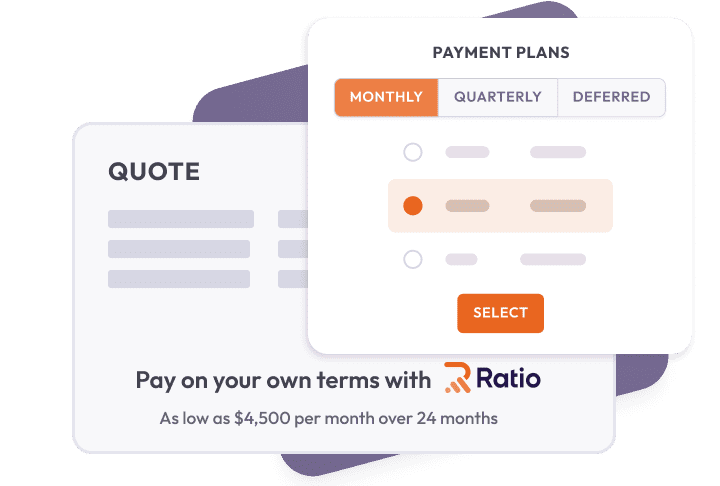

B2B BNPL allows startups to purchase essential equipment and services upfront while deferring payment over an agreed time frame. This approach ensures that suppliers receive payment promptly, streamlining the procurement process and eliminating costly delays. Moreover, B2B BNPL provides a secure and efficient payment method, benefiting both buyers and sellers.

In the realm of SaaS, BNPL solutions offer a game-changing approach to revenue generation. By embedding payment flexibility into every deal, SaaS companies can accelerate contract growth and enhance customer lifetime value. Annual Recurring Revenue (ARR), a crucial metric for investors and startups, becomes more attainable through these innovative BNPL solutions. With the ability to collect cash upfront, regardless of how customers choose to pay, tech startups can ensure steady cash flow and sustainable growth.

True Sale Financing: Unlocking Financial Opportunities

True Sale Financing emerges as a game-changing solution for tech and subscription-based businesses seeking to optimize their financial structure. This innovative approach allows companies to convert future receivables into ongoing funding, providing them with the freedom and flexibility to manage cash flow effectively. Unlike traditional lenders or equity investors, True Sale Financing does not result in ownership dilution, making it an attractive choice for startups looking to secure working capital without sacrificing equity.

Furthermore, True Sale Financing assumes contract risks on behalf of the company, reducing financial burden and enabling startups to allocate resources to strategic initiatives. This financing approach also improves the balance sheet by transforming long-term illiquid assets into liquid cash, boosting short-term cash flows—a significant advantage for startups with fluctuating working capital needs.

Navigating Customer Acquisition Costs (CACs)

Customer Acquisition Costs (CACs) represent a critical metric for sales operations, regardless of a company's size. It measures marketing and sales expenses divided by the number of new customers acquired in a specific period. Optimizing CAC is vital for sustainable growth, as spending more on customer acquisition than what is generated in revenue is unsustainable.

To optimize CAC, businesses can focus on increasing customer lifetime value (LTV) by reducing churn rates and renewals. This approach can lead to upsells and cross-sells that boost Annual Recurring Revenue (ARR) without significantly increasing CAC expenses. Properly understanding the payback period for marketing and sales investments in terms of monthly recurring revenue (MRR) is essential for effective budgeting and ensuring that a company can expand while remaining financially sustainable.

Case Study: Ratio Tech – Leading the Way

To illustrate the real-world impact of B2B BNPL, BNPL SaaS, and True Sale Financing, we turn to Ratio Tech, a trailblazer in this field. As Nohtal Partansky, CEO of Sorting Robotics, puts it, "Ratio fills a need in the Robotics-as-a-service industry that no one else does. And they do it well." Ratio's expertise in these innovative financing solutions has not only helped tech startups transition smoothly into subscription-based models but has also provided the flexibility to accommodate customers' varied payment preferences. This has resulted in reduced dilution and increased enterprise value for Ratio Tech and its partners.

In the competitive tech landscape, it's clear that B2B BNPL, BNPL SaaS, and True Sale Financing are not just financing strategies; they are driving forces behind innovation and sustainable growth. As more companies embrace these approaches, we can expect to see further advancements in the Subscription Economy and a continued reimagining of how businesses generate revenue in the digital age.

With B2B BNPL, BNPL SaaS, and True Sale Financing, tech startups can innovate with confidence, knowing they have the financial resources to support their vision. As we look to the future, it's evident that the synergy between tech innovation and innovative financing solutions will pave the way for exciting new possibilities. These financial tools empower tech startups to maintain a healthy balance between growth and capital structure, driving success in the Subscription Economy.

Conclusion

In conclusion, the dynamic landscape of the Subscription Economy requires tech startups to adapt, innovate, and secure the financial resources needed for sustainable growth. B2B BNPL, BNPL SaaS, and True Sale Financing have emerged as powerful tools, providing flexibility, stability, and the ability to thrive in a competitive market. As technology continues to evolve, these financing solutions will play an increasingly crucial role in the success of tech startups, empowering them to reach new heights in the digital age.

In today's ever-evolving business landscape, the Subscription Economy has redefined customer expectations, shifting the focus from ownership to access. This transformation has given rise to subscription-based businesses, collectively known as "The Subscription Economy," where companies generate revenue through recurring payments rather than traditional product sales. In this article, we will explore how B2B Buy Now,…

Recent Posts

- Right Foot Marketing Group: Pioneering Excellence in Digital Advertising on Long Island

- Beepothecary Introduces Nature’s Finest Wellness Products: Bee Bread, Elderberry Syrup, and Creamed Honey

- Beepothecary Introduces Nature’s Finest Wellness Products: Bee Bread, Elderberry Syrup, and Creamed Honey

- Revolutionizing Heating Solutions with Expert Oil to Gas Conversions

- Revolutionizing Digital Marketing for Long Island Businesses